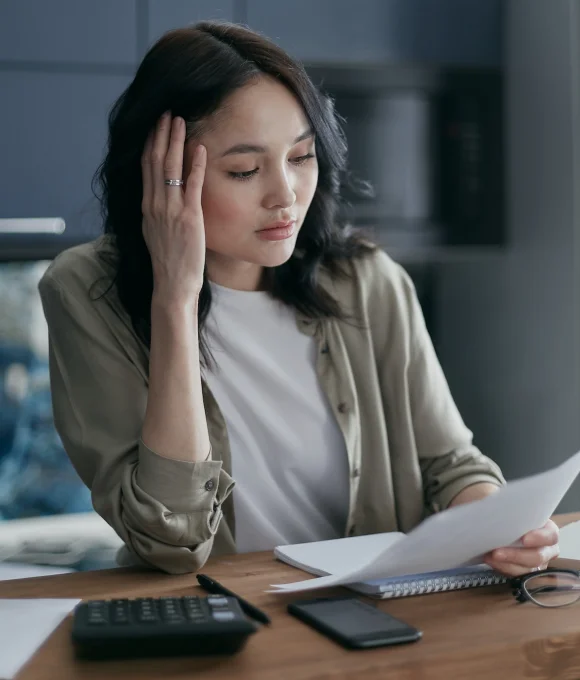

Debt Management

What We Offer

Take control of your debts and achieve financial freedom with our structured debt management plans.

Empower yourself with a structured plan to effectively manage and reduce your debts. Our debt management approach optimises cash flow, consolidates high-interest debts, and devises efficient repayment strategies for financial freedom and peace of mind.

As dedicated financial planners, we’ll assess your current debt situation, meticulously analyse interest rates and repayment terms, and craft a customised debt management plan. Our guidance extends to debt consolidation, budgeting techniques, and repayment strategies aimed at accelerating debt elimination and enhancing your overall financial well-being. Trust us to pave the way toward a debt-free future and improved financial health.

How we work

Experience the Difference - Why We Stand Out from the Crowd

1

Goals Discovery

Meeting

Embark on a transformative journey with our goals discovery meeting, where we uncover your dreams and aspirations to create a roadmap for financial success.

2

Research & Advice

Delivery

Experience the power of our meticulous research and expert advice, delivered with precision and tailored to your specific financial needs.

3

Strategy Implementation & Regular Review

We turn your financial goals into reality. Our team implements tailored strategies and offers ongoing reviews to ensure your dreams stay on course. Trust us to make your financial vision a reality.

Discuss your Financial Goal and Aspirations with a Senior Financial Adviser.

In this (15 minute) call you will also get to know about our services and

how we help our clients.

Our Services

Amazing Other Services

Investment

Grow your wealth with our strategic investment solutions customised to your goals.

Total and Permanent Disability

Ensure financial security in the face of a disabling condition with TPD cover.

Retirement Planning

Plan for a fulfilling retirement with our personalised strategies and expertise.

Superannuation

Superannuation is the cornerstone of your retirement plan, providing tax advantages.

Frequently Asked Questions

Answers at a Glance :

Your FAQs For Debt Management Addressed Set forth on a journey of financial assurance, steering through life’s crucial landmarks with the backing of our adept financial counsel. Attain your objectives and safeguard your future with personally crafted strategies designed to align seamlessly with your distinct requirements.

What is debt management?

Debt management is a strategy or service designed to help individuals pay off their debts in a more structured and manageable way. It often involves working with a financial advisor to develop a debt repayment plan.

How does a debt management plan work?

A debt management plan consolidates your unsecured debts into one monthly payment, which is then distributed to your creditors. This can often be accompanied by negotiated lower interest rates or waived fees.

Who can benefit from debt management?

Individuals struggling with multiple debts, high interest rates, or having difficulty making monthly payments can benefit from debt management. It can provide structure and potentially reduce overall costs.

Is debt management the same as debt settlement or bankruptcy?

No. Debt management focuses on creating a repayment plan for your existing debts. Debt settlement involves negotiating with creditors to pay less than what’s owed, while bankruptcy is a legal process that can discharge certain debts.

What role does a financial advisor play in debt management?

A financial advisor assesses your current financial situation, helps create a tailored debt repayment strategy, and offers advice on best practices to manage and reduce your debts effectively.

How can a financial advisor help me reduce my debt faster?

An advisor can provide insights into consolidating debts, negotiating with creditors, or restructuring your debts to secure lower interest rates and or making it tax deductible. We also guide on budgeting and savings strategies that can accelerate debt reduction.

Is it worth getting debt management advice for small amounts of debt?

While the strategies might differ, seeking advice for any amount of debt can provide clarity, structure, and peace of mind. An advisor can help ensure you’re using the most efficient methods to manage and pay off even small debts.